22/10/2020 – 22:34

The 2020-21 Federal Budget was handed down on the 6th of October 2020 and sends a clear message to all Australians that the Federal Government has their back as we embark on a job-led economic recovery.

A variety of unprecedented support measures were announced that will directly assist Sunshine Coast families, businesses, seniors, students and young people as the community digs deep and gets back to work.

I addressed the House of Representatives on the 7th of October 2020 on how the Budget might benefit the Sunshine Coast.

ECONOMIC RECOVERY – COVID-19 has resulted in the most severe global economic crisis since the Great Depression. In response, the Morrison Government has committed unprecedented support. JobKeeper is a $101 billion lifeline that is supporting around 3.5 million Australian jobs. JobSeeker doubled the safety net. Together, the Government’s actions saved 700,000 jobs. The Australian economy is now fighting back. The Budget sets out the Morrison Government’s economic recovery plan.

TAX RELIEF FOR WORKERS – More than 11 million taxpayers will get a tax cut backdated to 1 July this year. Lower and middle-income earners will, this year, receive tax relief of up to $2,745 compared with 2017-18. The changes mean more than 7 million Australians will receive tax relief of $2,000 or more this year. This rewards hard work. It means Australians will have more of their own money to spend on what matters to them, which will help local businesses and create 50,000 new jobs.

JOBMAKER HIRING CREDIT – A new JobMaker Hiring Credit will encourage businesses to hire younger Australians. The JobMaker Hiring Credit will be payable for up to twelve months and immediately available to employers who hire those on JobSeeker aged 16-35. It will be paid at the rate of $200 per week for those aged under 30, and $100 per week for those aged between 30 and 35. New hires must work for at least 20 hours a week. Treasury estimates that this will support around 450,000 jobs for young people.

KICK STARTING INVESTMENT – The Morrison Government is building on the successful Instant Asset Write Off. Over 99% of businesses will be able to write off the full value of any eligible asset, until June 2022. This will expand Australia’s productive capacity and create tens of thousands of jobs. For example, it means a trucking company can upgrade their fleet, a farmer can buy a new harvester and a manufacturer can expand their production line.

INVESTING IN SKILLS, TRAINING AND EDUCATION– 100,000 new apprenticeships and traineeships will be supported with a 50% wage subsidy for businesses who employ them. This is in addition to the 180,000 existing apprenticeships and trainees that are being protected. The new JobTrainer fund will create up to 340,000 free or low-cost training places for school leavers and job seekers. 50,000 new higher education short courses will be available, including in agriculture, health, IT, science and teaching.

MANUFACTURING, RESEARCH AND DEVELOPMENT – Manufacturing employs around 860,000 Australians. The Modern Manufacturing plan will target six national manufacturing priorities:

• food and beverage manufacturing;

• resources technology and critical minerals processing;

• medical products;

• recycling and clean energy;

• defence industry; and

• space industry.

The Morrison Government is also providing $1 billion for new research funding for our universities.

BUILDING INFRASTRUCTURE – Rebuilding our economy includes building more roads, rail and bridges. The Budget is expanding our record 10 year infrastructure pipeline, which is already supporting 100,000 jobs on worksites across Australia today. A further $14 billion in new and accelerated infrastructure projects will support a further 40,000 jobs. A further $2 billion is being invested in road safety upgrades, together with an additional $1 billion to support local councils to upgrade local roads, footpaths and street lighting.

GUARANTEEING HEALTH CARE – The Budget delivers record funding for health of $93.8 billion in 2020-21, an increase of almost 43% since 2014-15. Extending Medicare subsidised telehealth services has enabled over 30 million consultations since the crisis began. This Budget includes funding for new lifesaving medicines on the PBS – to treat leukaemia, melanoma and Parkinson’s disease and help women with ovarian cancer. This year, $5.7 billion is being provided to support mental health, including funding for critical frontline services and suicide prevention.

RECOVERY IN OUR REGIONS – The Budget will support regional Australia’s economic recovery by providing:

• $2 billion in concessional loans to help farmers overcome the drought;

• Funding to support regional tourism;

• A further round of the Building Better Regions Fund;

• $317 million for Australian exporters to continue to access global supply chains; and

• $2 billion in new funding to build vital water infrastructure as part of our national water grid including dams, weirs and pipelines.

SUPPORTING SENIOR AUSTRALIANS – To support Age Pensioners, the Government provided $750 payments in April and July. Age Pensioners will now receive an additional $250 payment in December and another $250 payment in March.

To support senior Australians who want to keep living at home, 23,000 more home care packages will be provided. This brings the total to more than 180,000 places, three times the number of home care packages than when this Government was elected in 2013.

INCREASING HOME OWNERSHIP AND SUPPORTING CONSTRUCTION – An additional 10,000 first home buyers will be able to purchase a new home sooner under our First Home Loan Deposit Scheme. This builds on the 20,000 first home buyers we are helping to purchase a home this year with a deposit as low as 5% under this Scheme. An additional $1 billion of low cost finance will support construction of affordable housing, taking total concessional finance available to community housing providers to $3 billion.

PROTECTING OUR ENVIRONMENT – This Budget includes $1.8 billion in funding for the environment. This will help our wildlife recover from bushfires and protect and enhance our natural environment. This includes $233 million in funding to upgrade facilities in Uluru, Kakadu, Christmas Island and Booderee National Park. This Budget is investing $250 million to modernise our recycling infrastructure, stop more than 600,000 tonnes of waste ending up in landfill and create a further 10,000 jobs.

You can download the above information HERE. For full details of all initiatives outlined in the 2020_21 Budget, as well as the Budget Papers, see HERE.

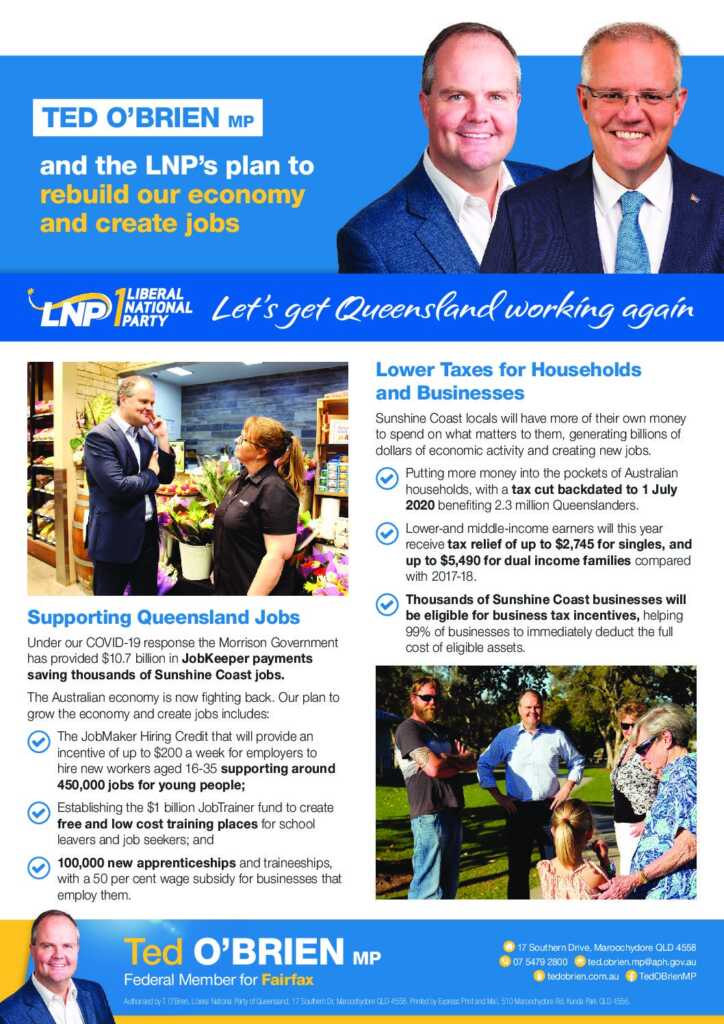

Download my Budget 2020_21 brochure HERE or click the image below: